Bitcoin is a highly volatile asset. We are still very early, so it’s quite probable that will be the case for a while. I’d argue that it’s a feature, not a bug, but obviously for the moment that can be percieved as a problem, especially for financial planning.

I’d also argue, that the best strategy invented to date is simply buy Bitcoin in regular intervals without regard for the price and hold for long term. But I understand that may not be for everybody and the emotional toll of huge price swings can be significant.

Fortunately, as the Bitcoin ecosystem matures, there are tools available to limit or even eliminate the volatility, while still holding Bitcoin.

Enter Perpetual Swap

Today, I’ll tell you about BitMEX Perpetual Contracts, also known as swaps, and how they can be used to reduce the volatility and generate some profit while doing so. BitMEX is a crypto-only exchange, meaning they don’t deal with any fiat currencies and only work with crypto-currencies. It also means, that they are not regulated in any way. Whether that is good or bad I leave up to you, but they are one of the more respectable players in crypto world. Can they be hacked and funds lost? Sure. Will they scam you? Probably not.

The perpetual contract is a special kind of future contract. Classic futures have some expiry and settlement date. Perpetual contract does not have any expiry or settlement date and therefore can be used for indefinite time periods. You are effectively locking a certain Bitcoin price and the value of the contract is determined by the difference between your locked price and current market price.

The contract can be used to bet on increase or decrease in Bitcoin price. If you believe the price will go up, you can buy the contract. If you think it will go down, you sell it. The beauty is you can also sell short, meaning you can sell the contract even if you don’t have any. You just need to be able to cover the price difference, if the price goes against your bet. And this is exactly the feature we will be using.

Fixing the USD value

In order to fix a certain USD value of the Bitcoin you hold, you have to sell the perpetual contract of the same value. You hold the Bitcoin in your wallet, like Trezor or Ledger and you hold the perpetual contract on BitMEX.

If the price of Bitcoin increases, the USD value of the Bitcoin you hold increases. On the other hand, the value of your contract decreases, or more precisely goes neagitve, in the same amount as the increase in the value of your Bitcoin.

If the price of Bitcoin decreases, it’s the other way around. The USD value of your Bitcoin decreases, but the value of the contract increases the same amount.

They effectively cancel each other out, so the overall USD value of your combined portfolio stays constant, no matter the price movement. Pretty neat, right?

The only real caveat is the margin requirement of BitMEX, which requires you to be able to cover the negative contract value in case the price of Bitcoin increases. Remember: if the price of Bitcoin goes up, the value of your contract is negative. This is fine, because the value of your Bitcoin is increased, but BitMEX does not know you have the Bitcoin in your private wallet, so they require you to keep enough Bitcoin in the BitMEX wallet to cover it.

If the overall negative value of your contract reaches the value of Bitcoin in BitMEX account, they will liquidate your contract. It’s not a complete disaster, you do not lose money, but you stop being protected against price fluctuations from that moment. It’s the same thing as if you cancelled, or more precisely bought, the contract yourself. Why bought? It’s a bit counter-intuitive, but it’s because when you entered the contract you actually sold it short.

Overall, it means you cannot actually hold all your Bitcoin in your offline wallet, but you must keep part of it on the exchange. Therein lies your counterparty risk, because if BitMEX is hacked or goes under, you loose the portion you kept there. How much that is depends on how has the price moved since you started hedging and also how much of a safety margin you want to keep. We’ll see all that in an example below.

Cherry on top: Funding rate

Protecting yourself from Bitcoin price fluctuations is a neat feature, if that’s what you need, but there is more. Every eight hours, so three times a day, the Funding event happens. In this event, based on the USD value of your contract, you either receive or pay the Funding rate, based on market status and other factors. You can read more about that in the contract documentation page. What’s important for us, the funding rate is almost always positive, meaning the longs pay the shorts (that is you). The rate fluctuates, but is usually at least 0.01%. With 3 fundings per day and 365 days in a year, this comes to a nice almost 11% p.a. The interest is paid immediately to your BitMEX Bitcoin wallet.

We can thus say, that the Perpetual swap can be used for two purposes:

- Fixing the USD value of your Bitcoin.

- Generating better-than-most interest revenue.

Example

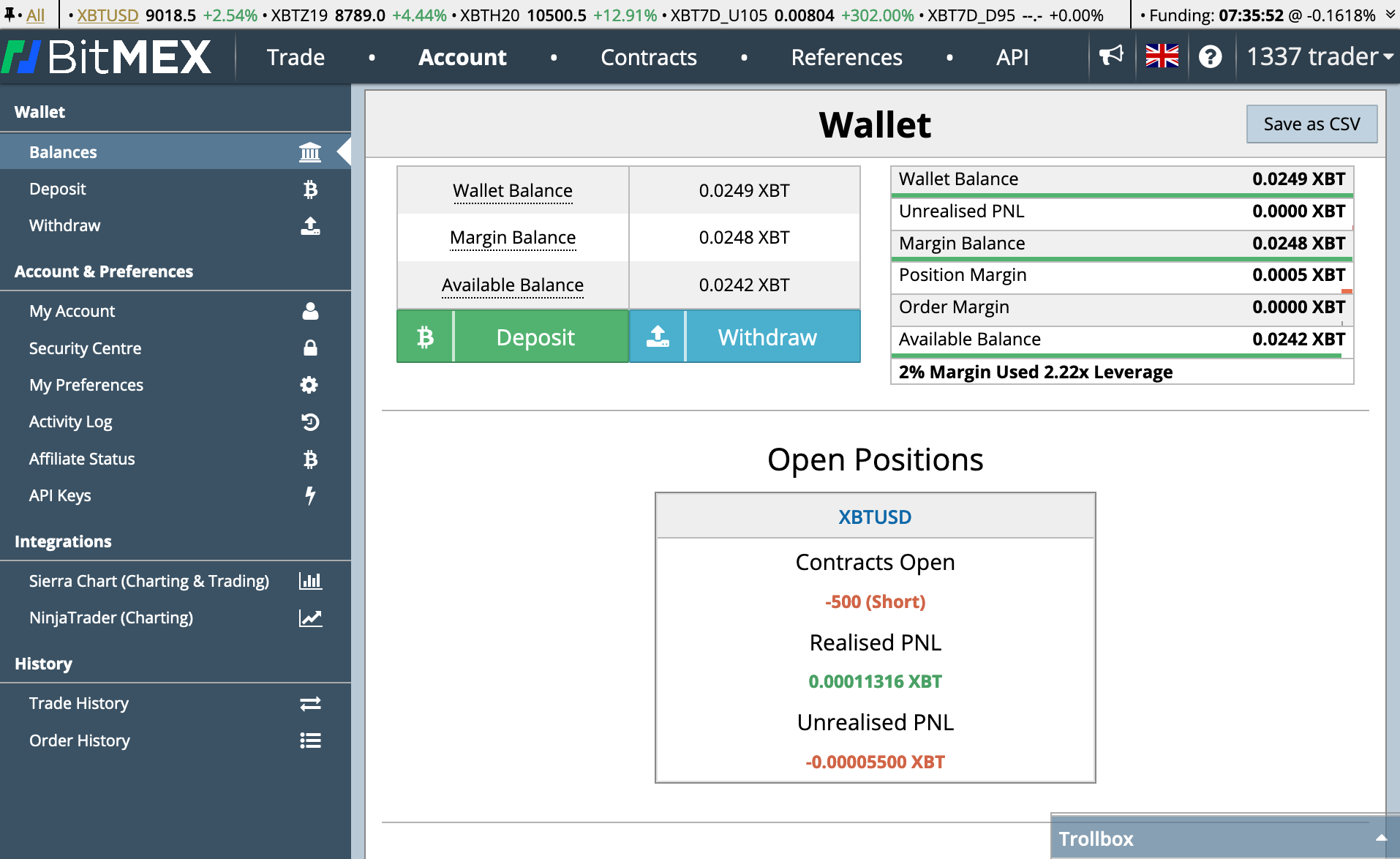

Let’s take a look at a real world example. In this example, you want to fix the dollar amount of $1000 worth of Bitcoin. At the time you want to fix it, the price of Bitcoin is $8000. That means you will work with 0.125 BTC, or 125 mBTC, or 12,500,000 satoshis, denomination is up to you. You transfer 20% of this Bitcoin (=0.025 BTC) to BitMEX, the rest of it (0.100 BTC) you keep in your Trezor. You sell a $1000 perpetual contract on BitMEX. Your unrealized profit/loss on this contract starts at 0.

In this example we’ll ignore the fees to keep things simple. In real life, the fee would be 0.0750%.

The market is bearish and the price of Bitcoin falls to $7000. The value of the Bitcoin you have (0.100 in Trezor and 0.025 on BitMEX) went down to $875. The contract value, on the other hand, went up proportionately and if you look at the unrealized profit it will show 0,017857 BTC, which is worth $125 at that time. If you need the $1000 now, you can liquidate the contract, realize the profit. You’ll end up with 0.142857 BTC, which if you sell at the $7000 it costs now, comes to $1000.

If the market went the other way and price jumped to $9500, it would look different. The value of your Bitcoin is now $1187. The unrealized loss on the contract is however -0.019737 BTC. Which again, if combined with your Bitcoin holdings is 0,105263 BTC and that means $1000 at the $9500 price point we’re at now.

There is however one significant difference, which we didn’t have to consider in the previous case. Because the value of the contract is negative, you must have the Bitcoin equivalent on the exchange to cover it. Before, I wrote that you transferred 0.025 BTC to the exchange. This still covers the -0.019737 BTC value of the contract, but only barely. If the price rose even more to $10000, your contract would be liquidated by the exchange. At that time, you still would have 0.100 BTC in your wallet, meaning your $1000 value was still there. But yout BitMEX balance would be wiped and from that moment you are no longer protected. If the price dropped again after that, you will be subject to the drop too.

So if the price rose to $9500 it would be wise to transfer a larger portion your Bitcoin holdings to BitMEX in order to keep a safe margin, preferably back to at least 20%.

The table below shows the value of your Bitcoin holdings and contract values at different price points.

| Price of BTC [USD] | Price diff [USD] | BTC holdings value [USD] | Contract value [BTC] | Contract value [USD] | Total value [USD] |

|---|---|---|---|---|---|

| $5000 | -$3000 | $625,00 | 0,075000 | $375,00 | $1000 |

| $6000 | -$2000 | $750,00 | 0,041667 | $250,00 | $1000 |

| $6500 | -$1500 | $812,50 | 0,028846 | $187,50 | $1000 |

| $7000 | -$1000 | $875,00 | 0,017857 | $125,00 | $1000 |

| $7500 | -$500 | $937,50 | 0,008333 | $62,50 | $1000 |

| $8000 | $0 | $1000,00 | 0,000000 | $0,00 | $1000 |

| $8500 | $500 | $1062,50 | -0,007353 | -$62,50 | $1000 |

| $9000 | $1000 | $1125,00 | -0,013889 | -$125,00 | $1000 |

| $9500 | $1500 | $1187,50 | -0,019737 | -$187,50 | $1000 |

| $10000 | $2000 | $1250,00 | -0,025000 | -$250,00 | $1000 |

| $11000 | $3000 | $1375,00 | -0,034091 | -$375,00 | $1000 |

| $12000 | $4000 | $1500,00 | -0,041667 | -$500,00 | $1000 |

To sweeten the deal, you will be earning something like 0.01% every 8 hours you keep the contract open. That is 30 cents daily, $9 monthly or $110 per year.

Practical guide

If you’d like to either fix the price of your Bitcoin or generate profit from the funding rate, you can give it a try with these suggested steps.

- Create an account on BitMEX. Because it’s crypto-only, there is none of that KYC/AML nonsense.

- Create also an account on BitMEX Test site and familiarize yourself with the interface. If you need some more Testnet Bitcoins, there are plenty of places to get them from for free (the are worthless). Just google for “testnet bitcoin faucet”.

- If you don’t have it yet, buy a Trezor and set it up. Make sure you have the backup of your seed somewhere safe and test the recovery process.

- Transfer the dollar or Euro amount you want to invest to your Bitcoin exchange of choice. I have good experience with Czech-based Coinmate.io or slovenian Bitstamp. Just make sure it’s a regulated exchange because you are dealing with fiat.

- When you have the money in the exchange, buy the Bitcoin. It really does not matter what the price of Bitcoin is at the moment. Just make sure it’s not in some huge rise or fall at the moment, because you will need a bit of time. Immediately transfer it to your Trezor.

- After it arrives, send 20% of the BTC to your BitMEX wallet address.

- Sell the XBTUSD contract of the desired value.

- You are now covered and price fluctuations of Bitcoin will not affect the total value of your holdings. You will start generating the interest from the funding rate.

- Install some price monitoring app (I personally use Blockfolio) and set an alarm at something like 10% below your liquidation price, so you have some time to send additional Bitcoin to BitMEX in case the price increases significantly.

If you are a bit tech savvy, take a look at Juraj Bednár’s excellent automation scripts. His blog is definitely a recommended reading and I drew a lot of inspiration from him for writing this article.

That is all I have for you today. As always, make sure you understand the things you are doing and don’t do anything, unless you feel comfortable with it. Remember, with Bitcoin, you are your own bank. There is risk in that. But anything that’s worth anything involves risk.

I built a little tool to help with monitoring of the contract position.

Comments